Tap N Pay Your Way Through Your Holiday

Easy, Secure & a Convenient Way to make small purchases

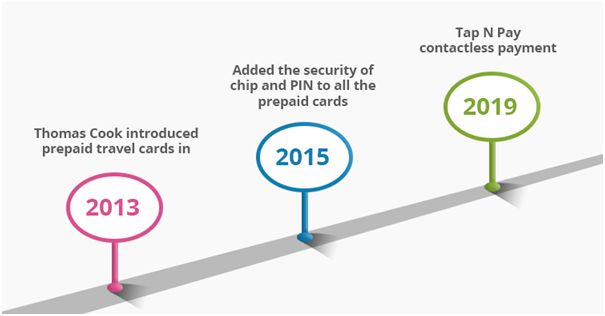

Tap N Pay is a more secure way to pay since your card remains in your hand all the time. It also ensures minimal contact with other people. This technology has evolved over the past decade and has gained acceptance in the mainstream rather quickly. Debit and credit card payments really took off in India after the 2016 demonetization drive. But payment cards were already being used extensively around the world to make payments. To understand this evolution and acceptance, we must go back a few years to understand the history of credit cards.

The (Hi)story of Cards

Money has been around in one form or the other from ancient times. From beads and blocks of salt to metal coins to paper currency, money had a long journey before it went paperless. While money is practically ancient, credit cards are just 72 years old at this point. The idea of a credit card was born when a businessman, who had taken his clients for dinner, discovered that he had forgotten his wallet home.

While the rest of the details are unclear, the incident was responsible for the birth of the “Diners Club Card”, the ancestor of the credit cards that we know and use today. It quickly gained acceptance for the convenience it offered. As its use became widespread, more features such as the magnetic strip and the security PIN were added. Interestingly, the PIN made its debut in 1967, 12 years before the magnetic strip, which was introduced in 1979.

There were no new innovations in payment cards for the next 16 years until the Seoul Bus Transport Association launched the world’s first contactless payment card for its commuters. It was the next logical step in the evolution of payment cards.

What is contactless payment?

Like its name suggests, contactless payment is the method of paying for your purchases without the need of handing over your card to another person or swiping it through the card machine. If a POS machine supports contactless payments, you can simply tap or wave your card near a designated spot on the machine to pay for your purchases. That spot will be marked by the easily recognizable (wifi)symbol of contactless payments.

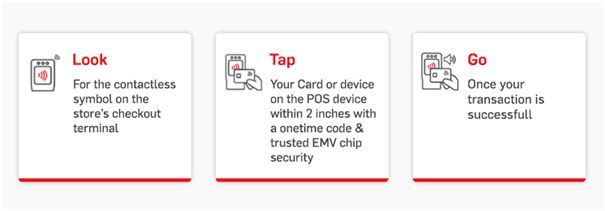

How does it work?

Contactless payment works predominantly on wireless technology. Now, all major payment cards are compatible with contactless payments and come equipped with the necessary hardware. Contactless cards are embedded with RFID (Radio Frequency Identification) or NFC (Near Field Communication) chips which are read and recognized by compatible POS or card payment machines. It is a simple process.

- The merchant scans all your purchases in their POS machine.

- Once the final amount is generated, they will initiate the payment process.

- The payment machine then searches for a contactless payment card to accept payments.

- At this point you wave your contactless payment card in front of the machine within 5 cm.

- The machine then reads the data from your card and sends it to your bank for approval.

- Your transaction is complete after the machine receives approval from the bank.

- You do not have to enter your PIN if your purchases are below

That’s it. You have successfully paid for your purchases with a contactless payment card.

How secure are contactless payments?

People have always worried about security while using payment cards. But barring deliberate attempts to steal and misuse a payment card, it is a safe mode of payment. Contactless payment card transactions are protected by encryption that makes it difficult to intercept and manipulate them. While low-value transactions do not require any passwords, higher-value transactions are protected by a secure PIN. Most of the fears and misunderstandings about contactless payment stem from its security point of view. Since we are looking at its security aspect, let’s bust some myths associated with contactless payments.

5 Contactless Payment Myths Busted

- You may accidentally pay more than once for the same transaction.

Contactless payment systems have built-in measures to prevent such occurrences. There’s also a slight delay between you tapping the card and the machine receiving back approval from your bank. It won’t charge your card twice even if you accidentally tap it twice.

- Your contactless payment card can be easily “Pickpocketed” by a thief with a contactless terminal.

A contactless payment terminal is not easily available. If a business wants a card payment machine, they must apply for it with banks or other financial institutions. They must go through a comprehensive KYC process that includes submitting various documents. Contactless payments are electronic payments, and these measures make all such transactions 100% traceable.

- A thief with a stolen contactless payment card can spend large amounts of money or make numerous small purchases.

All high-value transactions with a contactless payment card need a PIN to make purchases or withdraw money. So those are out of the question. On the other end, card companies limit the number of small transactions you can make on your card. So it limits the amount that a thief can spend. You will also receive an alert when they make the first transaction, which means you can call your card company to report it stolen and have it blocked.

- A thief can clone a payment card using a card reader.

All the details on a contactless payment card are encrypted. That data can only be read by genuine and verified POS machines issued by banks and other financial institutions. So anyone with a rouge card reader cannot steal your card data. Even if they manage to steal it, the data will be useless to them without a decryption key.

- A thief can also steal your identity along with your card data.

A contactless payment card is designed in such a way that it does not transmit any of your personal data while it is being used. All it transmits is the card information which is mapped to your name and account number on the bank’s servers. So your identity is safe.

Now that these myths are busted, and you know that contactless payment cards are safe to use let’s look at some of its advantages.

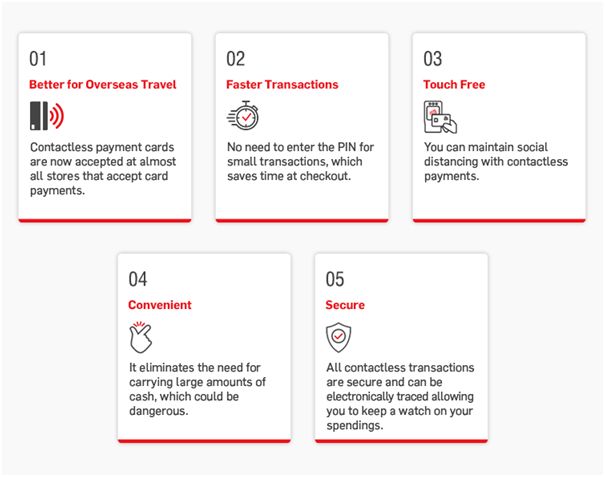

Advantages of Contactless Prepaid Cards

As per the latest Visa report(The Visa Back to Business Study 2021 Outlook), contactless payment cards have gained a large acceptance in various markets around the world. Australia has 98.6%, the UK has 81.5%, France has 69.6%, Germany has 82.6%, Singapore has 95.2%, and Hong Kong has 77.1% penetration of contactless payment cards. The reasons behind such a large acceptance are the advantages listed below

Enjoy the contactless advantage with Thomas Cook Prepaid Cards

Today, a Thomas Cook prepaid card is the most preferred way to buy forex for holidays or studies abroad. It offers all the conveniences of a regular contactless card and adds more protection against fraudulent activities with insurance of up to USD 10,000. It allows you to make purchases up to USD 35 without entering the security PIN. This is a highly underrated but useful feature, especially during these times of social distancing. You do not need to hand over your card to make payment. Simply tap it against a POS (Point of Sale) terminal that supports contactless payments, and your payment is done. You can add more convenience to your holidays abroad to Australia, Canada, South Korea, and the United Kingdom. Pair that with the signature Thomas Cook hospitality and you get a seamless and memorable international holiday experience.