Things To Remember When Withdrawing From An ATM Abroad With Local Bank

Table of contents

When you are traveling abroad, money management becomes an issue that one needs to take care of. Many of us believe that it is an easy process and tend to leave the fund management on the local ATMs. The ATMs in the foreign countries are the best way to transact local currency. Whether it is Yen or Pound or Peso, an ATM is the easiest source of cash.

While traveling abroad, one needs to follow some simple and easy rules when they are withdrawing money from a foreign country’s ATM. These tips will help you save your hard earned money on unnecessary transaction fee.

1. Research About The Local ATM Rules

Read About The ATM Rules Abroad

Every country has a set of rules when it comes to ATM transactions. Some banks allow you a certain limit of free transactions while others start charging the fee with the first withdrawal itself. It is recommended to do a proper research on the number of free withdrawals, general rules about the local ATMs and the fee they would charge.

Also, make sure that the fee is the same for every transaction or if it increases after a certain amount of monthly transactions.

2. Sign Up With A Bank That Is Part Of The Global ATM Alliance

The Global ATM Alliance is a group of banks coming together. These banks allow customers to use their ATM card or debit card at another banks without paying any extra surcharge. These banks have a worldwide presence and make it easy for the travellers to get their money.

The banks under this alliance charge no transaction fee on money withdrawal. Having an account in one of these banks gives your debit card an international value. With this facility you are able to avoid the ATM access fee.

Certain ATMs and banks still charge for the international transaction and currency exchange fee depending upon their guidelines.

3. Find A Compatible International ATM

Find A Compatible ATM

When you are in a different country, your ATM probably won’t be accepted by a couple of machines. The reason being that in the foreign countries, a number of international banks have their own ATM chains and you can only transact money from those given ATMs.

Before you start your journey, make sure that you have researched on the list of ATMs, banks and their locations so that you don’t get in trouble upon landing in that country.

4. Pre Inform Your Bank

A lot of times a transaction from a new location or another country makes your bank suspicious. As a result they block your card. It is important that you let your bank know about your travel dates and the countries you’ll be visiting so that they don’t block your card on the grounds of suspicion. Not a good idea to avoid this step; it can make you end up penniless in an unknown foreign land.

5. Always Travel With Multiple ATM Cards

Travel With Multiple Cards

Multiple ATM cards help you with the smooth process of the transaction without any hassles. Having two ATMs also save you from the trouble in case you end up losing one of the ATMs or if one gets blocked by the bank because they got suspicious of your transactions. It is better to avoid being cashless and helpless in a foreign land and keep an emergency debit card just to overcome situations like these.

On a negative side, you may end up paying the transaction fee for two ATM cards instead of one. But you can always avoid that by not using the other ATM and only keep it for emergency purposes.

6. Avoid Transaction Through Your Credit Cards At All Costs

Avoid Transactions Through Your ATM Card

While credit cards allow withdrawing cash from the ATM machines, it is highly advised that you should not do that. Credit Cards have a high transaction fee for withdrawing money in the home country itself. This increases multiple times when you take out cash from the ATM at another country.

It will put you in a serious debt. You are advised to avoid this practice and make sure that all your transactions are through a debit card or via a Forex card.

7. Keep A Foreign Exchange Card

Image Source: lakshmisharath (forex card)

A Forex card or a foreign exchange card is a virtual medium of the transaction with the local currency added in it. This Forex card is handy for foreign travel because it doesn’t come with any transaction charges or withdrawal fee. You get a hundred per cent of your cash that you have recharged your card with.

Many shops and hotels offer cash back and special amenities with their choice of cash cards. With a forex card, you can ease your pain of carrying cash in your pocket around and worry that you’ll lose it somehow.

Suggested Read: Benefits Of Having A Forex Card

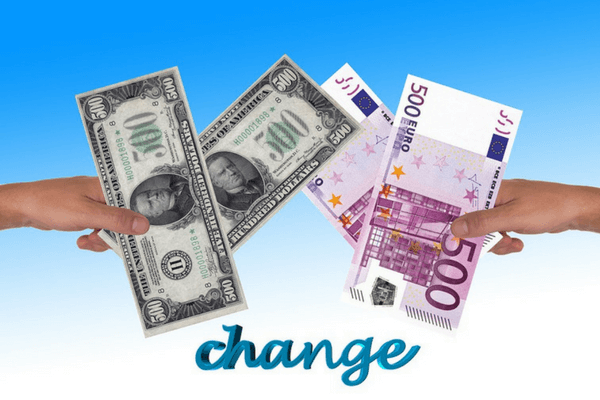

8. Keep A Track Of Exchange Rates

Keep A Track On Exchange Rates

The exchange rate is basically the cash that you’ll receive in the local currency when you are withdrawing money from that country’s ATM. Every time you make a withdrawal, a certain amount will be charged as a fee that you need to keep a track about.

While ATM withdrawal fee doesn’t change and usually vary from 1.8% to 2%, it can still help you save some cash on your journey. Withdrawing direct cash from ATM gives you an edge over collecting cash from an exchange office because 1) it is quick and 2) the exchange rate is higher at the counter.

Also Read: Buy Foreign Exchange From The Comfort Of Your Home

9. Avoid ATMs With Dynamic Currency Conversion System

A lot of ATMs lure tourists by offering them conversion to their home currency. It is usually a trap and they charge an insane amount of money for converting your local currency to Dollar. Since Dollar is the second currency of many countries, tourists easily get lured into this trap and end up paying a high amount for transaction charges for no reason.

10. Always Make Use Of Cashback And Discount Offers

Make Use Of All The Discount Offers

A lot of restaurants, shops, and hotels offer cool discount and cash back offers when you make a direct transaction, through your ATM or Credit card. With each transaction you are eligible for certain additional amenities at their establishments. Certain shops offer cash back on the purchase and you end up getting a part of your money (5% to 10%) back in your account.

This way you can spend your holidays the way you want. At the same time, you’ll be making use of some amazing exciting offers.

With these simple tips you can avoid getting cheated and spending too much money because some ATM machine charged you an unnecessary fee. Make sure that you follow all these tips on your next foreign trip.

Table of contents

Trending blogs for you

18002099100

18002099100