Why Traveller’s Cheques Are Dying Out

Table of contents

In the 1990’s, everyone was using travellers cheques to carry their money abroad. In 2020, exactly 20 years later, travellers cheques are being replaced with forex cards. How did this happen?

At one time, traveller’s cheques were safe, easy to use and accepted everywhere, because if you lose them, they were easily replaced, wherever you are. However, travellers cheques are not as safe as they used to be. And there are still people who choose to use them because they come with certain advantages:

- They are available in multiple foreign currencies

- If you lose them, or they get stolen, they can be refunded

However, you get the same benefits, and more, when you choose a Forex card. Unfortunately, there are many disadvantages of using travellers cheques. Check these out below:

Travellers Cheques Are Not as Safe as They Used to Be

These days, if you step into a shop or a restaurant, you might find it a little more complicated to pay with a cheque. Many business owners are suspicious of travellers cheques. They can be forged, which means your cheques will be scanned for any marks or patterns before they are accepted.

For you, the customer, getting the cheque accepted can be a bigger problem. You may need a manager to authorise your cheque before you cash it. Also, even if your cheque is accepted, you’ll still need to show 2 types of identification. This means that you’ll be spending a lot of time on your holiday getting your payments done, rather than enjoying it. And paying for a simple dinner can become a long and frustrating process. Why waste time?

Traveller’s Cheques Kill Any Spontaneous Plans

You’re walking down the street and you see something you want to buy. Or you want a small snack. If you’re using a travellers cheque to pay for it, it will take time. There’s no time to be spontaneous when you need to go to the local bank or currency exchange to get cash.

What’s worse? If there is a bank holiday or if there is an emergency, you can get stuck. While you do need to plan out your trip, you also need some spontaneous fun!

Traveller’s Cheques are Expensive

Planning a trip abroad is expensive, specially if you’re headed to Europe or the US. So, you need to be able to save as much money as you can. This way, you’ll be able to fully enjoy the experience. Unfortunately, traveller’s cheques are expensive. If you compare traveller’s cheques to Forex cards or debit/credit cards:

- They have a higher interest rate

- They have higher exchange rates

- Banks charge an additional fee to issue your traveller’s cheques

All of this can eat into your trip budget.

Traveller’s Cheques aren’t Accepted Everywhere

Not every shop or restaurant accepts traveller’s cheques as payment. This is especially true for the smaller businesses. For the business owner, it takes extra time and money to process the cheque. If you’re looking to try out some smaller restaurants or shops, you’ll need cash or a card. This just makes your traveller’s cheques unnecessary.

Replacing Your Traveller’s Cheques Can Take Days

Here’s the good news! If you lose your cheques, or if they get stolen, you can replace them! Now, for the bad news – this could take a long time. Plus, there are some other problems:

- You’ll need to keep your shopping receipts with you for the record

- You’ll need a list of the cheque serial numbers – both the used cheques and the stolen ones

- If the cheque issuer’s location is far from you, it takes much longer to replace them

It can take a couple of days before you receive your replacement cheques. By that time, you would have lost your valuable vacation time. Or, you might have spent all the cash you have in hand. How would you survive in a foreign land without any money?

To Conclude, Traveller’s Cheques Can be a Hassle

- Many countries have different uses for traveller’s cheques

- Some countries also keep a limit on the amount you can spend on cheques

- There may be a limit on how much currency exchange you can do with a cheque

- You may also need to spend extra commission and exchange fees.

But if you use forex card, all you do is preload it with the currency of your destination and swipe it like a debit card. Forex cards offer best rates, do not attract additional charges when swiped, and can be easily topped up from your bank account if you need the extra cash. And they also offer more security features when compared to travellers cheques.

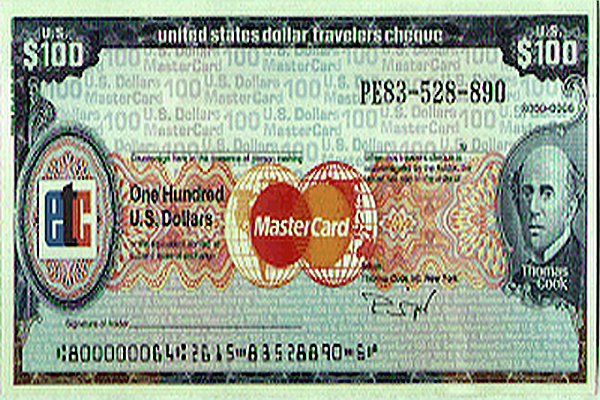

Check out Thomas Cook’s Travel Prepaid Forex Cards which are an easy, convenient and a say way of buying foreign currency and taking it with you when you travel internationally.

Table of contents

Our Forex Offerings

Trending blogs for you

18002099100

18002099100