Everything You Need to Know About Foreign Currency Exchange

Table of contents

Are you an Indian planning a trip abroad in the coming vacations? Do you want to send your daughter abroad for further education? Do you need to travel out of India for a business trip? If you answered positively, then you should learn all about foreign currency exchange to ensure smooth financial transactions during your stay out of India.

1. What Are Foreign Exchange Limits for Individuals When Traveling From India?

Currently, under the Liberalised Remittance Scheme (LRS), any resident of India including minors are allowed to remit up to USD 2,50,000 i.e. Rs 2.5 lakh US Dollars in a financial year. At an exchange rate of Rs 73 per dollar, the amount would be Rs. 1,82,50,000. For minors, their guardians can sign LRS declaration form on their behalf. This does not apply to corporates, HUF, partnership firms, Trusts, and other organizations.

1. For Employment Purpose

Abroad Employment

A person travelling abroad from India for employment purpose can draw up to USD 2,50,000 from any authorised dealer. You can make use of Thomas Cook currency exchange to draw foreign exchange as per your requirements.

2. For Business Trip

Business Trip

If you are going abroad from India for attending a specialised training, international conference, apprentice training, seminar, or any other business trip, you can get foreign exchange up to USD 2,50,000 for any number of visits per year. you can get foreign exchange up to USD 2,50,000 for any number of visits per year.

Suggested Read: Things To Remember When Withdrawing From An ATM Abroad With Local Bank

3. For Studying Abroad

Abroad Studies

The maximum money you can transfer from India for students studying abroad/going to study abroad is US$ 2,50,000 without any estimate from the foreign University. Currency exchange services by Thomas Cook can ease your process of transferring money abroad for paying college/university fees.

4. Medical Treatment

Medical Treatment

If you are going abroad for medical treatment, you can get foreign currency exchange up to USD 2,50,000 without any estimate from a doctor or hospital in India or abroad.

5. Gift/Donation

Gift or Donation

You can gift or donate up to USD 2,50,000 each financial year as gift or donation to a person or organization abroad.

6. For Private Visits

- Individuals traveling to all other nations other than Iran, Iraq, Libya, Russian Federation, and any other Republic of Commonwealth of Independent States are permitted to buy foreign currency notes and coins up to USD 3000 only per visit. You can carry balance amount in form of Travellers cheque, debit or credit card, store value cards, and Demand Draft. So, make no delay in contacting Thomas Cook to buy foreign exchange or sell forex to enjoy a hassle-free trip abroad.

- If you are visiting Libya or Iraq, you can draw foreign exchange in form of foreign currency coins and notes up to USD 5000 or equivalent per trip.

- When traveling to Russian Federation and other Republics of Commonwealth of Independent States or Islamic Republic of Iran, you can benefit by drawing entire foreign currency exchange up to USD 2,50,000 in form of notes and coins of foreign currency.

- While traveling for Haj/Umrah pilgrimage, you can get the entire amount of entitlement i.e. USD 2,50,000 in cash or till cash limit as per the Haj Committee of India.

Suggested Read: Great tips for buying Forex while travelling

2. Three Best Ways For Foreign Currency Exchange When Traveling Abroad From India

1. Prepaid Forex Card

Forex Prepaid Cards are smart, convenient and secure alternative to carry foreign currency while travelling abroad. Multicurrency Forex Card or Borderless Prepaid Travel Card, like one available at Thomas Cook, is one of the best and safest options to carry out smooth transactions when traveling to different countries at reasonable foreign currency exchange rates.

2. Credit & Debit Cards

Credit And Debit Cards

Carrying credit and debit cards are another safe option for smooth transactions abroad at reasonable foreign exchange rates.

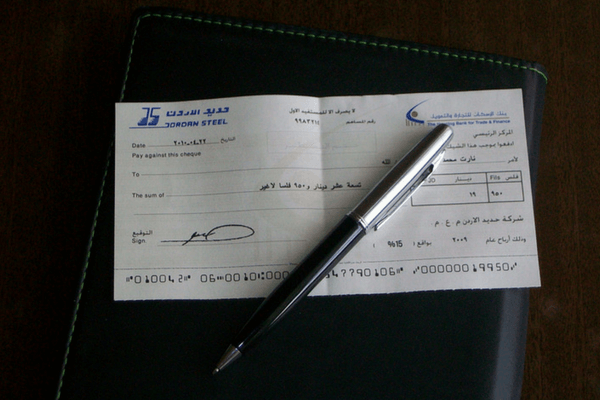

3. Travellers Cheque

Travellers Cheque

Get your Travellers Cheque from Thomas Cook for safe, smooth, and easy transactions in foreign countries without any concerns.

So, make no delay in contacting Thomas Cook for your foreign exchange requirements to enjoy a hassle-free trip abroad.

If you have planned everything about your travel and not about the currency you should be carrying, then this might bother you while you are away for some fun time. Read our blogs to know everything about foreign currency exchange while traveling from India.

Table of contents

Our Forex Offerings

Trending blogs for you

18002099100

18002099100